This case study shows how Knock Knock Digital built a scalable ClickUp for e-commerce management system to automate product launches, improve visibility, and save 31+ hours per week while scaling across UAE and KSA markets.

20hrs

Saved Weekly

15%

Lead Conversion Growth

99%

Deadline Met

Results Highlights:

-

85% of operations systemized: The vast majority of SDA CPA’s workflows are now standardized and running through ClickUp, transforming a previously ad-hoc process into a streamlined system.

-

20+ staff hours saved per week: Automation and smarter workflows freed up dozens of hours daily that were once spent on manual tracking and coordination, allowing the team to focus on high-value client work.

-

Missed deadlines nearly eliminated: With tasks, dates, and reminders all in one place, the firm went from frequent deadline scares to virtually 0 missed deadlines, ensuring on-time tax filings and deliverables for clients.

-

Real-time visibility & collaboration: Custom dashboards in ClickUp give managers and staff instant insight into workloads, deadlines, and client status. Team collaboration has improved as everyone operates from a single source of truth instead of scattered tools.

-

Better sales tracking and growth: A built-in CRM and automated follow-ups mean no prospective client falls through the cracks. SDA CPA now tracks leads and referrals in ClickUp, leading to more consistent new client onboarding and growth opportunities.

Introduction

SDA CPA is a forward-thinking accounting firm based in Dunwoody, Georgia, dedicated to making small business accounting stress-free. Founded by Stanley Dean, a CPA with over three decades of experience, the firm has a mission to relieve the burdens of bookkeeping, taxes, and payroll for entrepreneurs. Unlike traditional CPA practices that only check in at tax time, SDA CPA works year-round as a proactive partner – providing monthly accounting services for a fixed fee and using modern cloud tools to keep clients informed on their financial health. This client-first, tech-savvy approach earned SDA CPA a loyal base of about 70 small business clients and a reputation as a dependable financial guide for growing companies. By 2025, however, the firm’s success brought new challenges: with growth in clientele and a expanding team, SDA CPA needed more robust systems to maintain their high service standards without overloading their staff.

Company Overview

Founded in 2003 by University of Georgia alum Stanley Dean, SDA CPA has grown into a trusted name among Atlanta’s small business community. With experience at global firms like PricewaterhouseCoopers and Dow Chemical, Stanley launched SDA CPA with a vision to make accounting more approachable, consistent, and tailored to business owners. The firm gained recognition early on and was named one of the fastest-growing UGA alumni-owned firms five times.

Today, SDA CPA serves over 500 clients with a team of 20+ professionals who specialize in accounting, payroll, and financial advisory. Known for their no-surprise pricing and unlimited consultation model, the firm prides itself on transparency, client service, and deep technical expertise. In 2016, the company made a strategic decision to focus exclusively on small businesses, discontinuing individual tax returns to double down on long-term partnerships. Their mission: make accounting stress-free for entrepreneurs.

Location

USA

Use cases

ClickUp, CRM & Make.com implementation

Industry

Accounting & Bookkeeping

Employees

10+

Challenges

Despite SDA CPA’s strong client relationships and modern approach, the firm’s operations behind the scenes were struggling to keep up with growth. The partners identified several pain points that were causing inefficiencies and stress:

-

Lack of a CRM for leads:

The firm relied on word-of-mouth and referrals for new business, but they had no dedicated system to track prospects or sales leads. Inquiries from potential clients were noted in emails or spreadsheets and easily forgotten. Without a CRM, follow-ups were inconsistent – meaning missed opportunities to onboard new clients that had expressed interest. -

No process automation:

Nearly all tasks were handled manually by the team. Recurring monthly work (like reconciliations and reports for each client) had to be recreated or tracked by memory. There were no automations or templates in place, so staff spent time on repetitive setup steps and routine data entry, cutting into time that could be spent on client service. -

Missed deadlines and fire drills:

With roughly 70 clients and numerous filing deadlines (monthly bookkeeping closes, quarterly tax estimates, annual returns, etc.), things were starting to slip through the cracks. The firm had occasional scares with missed or last-minute filings because there wasn’t a central calendar or reminder system. Every partner meeting brought anxiety about “What are we missing?” which was not sustainable for a growing practice. -

Scattered tools and data silos:

The team used a mix of emails, shared folders, spreadsheets, and their accounting software to manage work, but these tools were not integrated or centralized. Client task lists might live in Excel, communications in email threads, and documents in Google Drive – making it hard for anyone to get a quick, complete view of a client’s status. This scattershot approach wasted time and led to confusion, especially when team members had to cover for each other. -

No dashboards or real-time oversight:

The partners lacked a high-level view of operations. Which deadlines are upcoming? Which tasks are overdue? How is each team member’s workload? Getting answers meant manually checking with staff or piecing together info from different sources. The absence of dashboards or reports meant limited visibility into performance and no easy way to spot bottlenecks or allocate resources. -

Inconsistent processes and quality control:

Because SDA CPA had grown organically, each accountant had developed their own way of doing things. There were few standardized SOPs (Standard Operating Procedures) or checklists. This led to minor inconsistencies in deliverables and client experience. For example, one bookkeeper might include a cover sheet on a financial report while another might not. The lack of documented procedures also made training new hires difficult – new staff had to learn by shadowing, and the firm risked quality issues if a key employee was out or if workload spiked.

These operational challenges were holding back SDA CPA’s ability to scale. The leadership recognized that to continue growing (and to maintain their hard-earned reputation), they needed to overhaul their internal systems. They required a central platform to organize work, automate routine tasks, and provide visibility – in short, they needed to systemize their operations. That’s when Camel Tech was brought in to help craft a solution using ClickUp, an all-in-one productivity platform. Enter Camel Tech.

Transformation with Camel Tech

Camel Tech partnered with SDA CPA on a comprehensive transformation project, following our proven 6-step process to implement ClickUp and turn the firm’s challenges into strengths. Over the course of a few months, Camel Tech worked closely with Stanley and his team through each phase – from initial discovery to continuous improvement – to ensure the new system fit their needs and was fully adopted. Here’s how the journey unfolded:

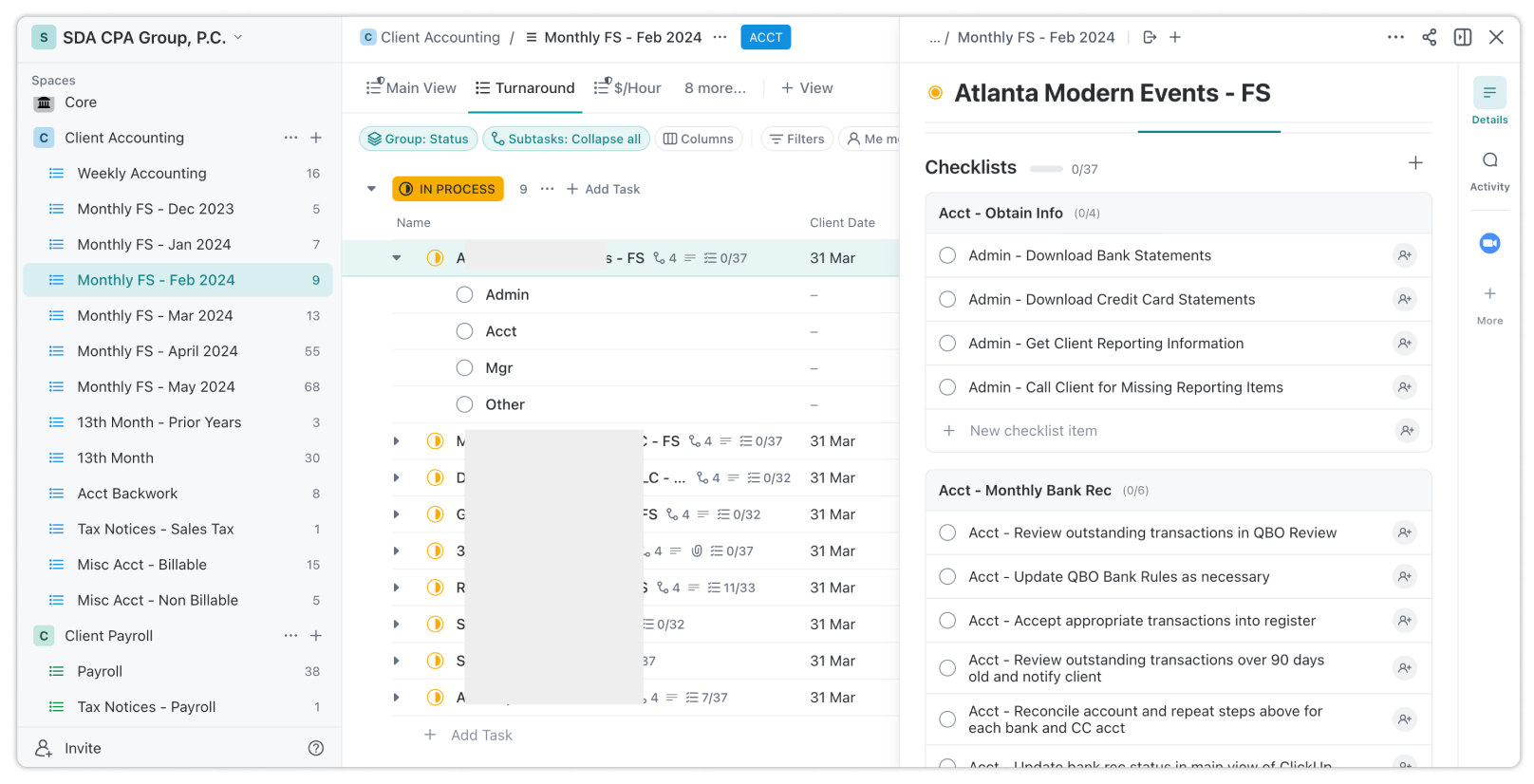

1. A centralized client task management:

We created a structured ClickUp workspace where each client has a dedicated space with recurring monthly task lists like bookkeeping, payroll, and tax prep. Each list is preloaded with standardized tasks and subtasks, eliminating the guesswork and ensuring consistency. This transformation allowed the SDA CPA team to shift from scattered spreadsheets and reminders to a single dashboard where all work is tracked and visible.

2. Automated recurring workflows:

Previously manual processes—like recreating monthly bookkeeping tasks or reminding staff of deadlines—are now handled automatically. We set up automations to generate recurring checklists, assign them to the right team members, and trigger reminders as deadlines approach. As a result, staff no longer spend hours each week setting up or chasing routine work, saving 20+ hours per day collectively across the firm.

3. ClickUp CRM for sales & onboarding:

We implemented a CRM inside ClickUp to track every lead, from first inquiry to signed engagement letter. With custom sales stages, automated follow-up tasks, and centralized lead records, the team can now stay on top of opportunities without relying on memory or email flags. This system significantly improved sales conversion rates and allowed SDA CPA to manage onboarding steps with confidence and speed.

4. Real-time dashboards:

To provide leadership with clarity and control, we built dashboards that pull live data from every workspace. Partners can now see overdue client tasks, employee workloads, upcoming deadlines, and sales performance—all in one place. These dashboards became a game-changer in daily check-ins and weekly leadership meetings, replacing guesswork with data-driven decisions.

5. Documented SOPs & templates:

We helped document all major processes—monthly close, new client onboarding, tax season workflows—into ClickUp Docs and connected them to tasks. This not only standardized operations but also cut down training time for new hires. Staff now execute tasks with confidence, using predefined templates and procedures that ensure nothing gets missed.

6. Integration of client data & files:

Client documents, checklists, and internal notes are now linked directly inside tasks. By integrating cloud storage and connecting calendars, all necessary information is easily accessible from one place. Whether it’s a bank statement or payroll deadline, the team finds everything in context, which drastically reduced back-and-forth and improved task completion accuracy.

Through each step of this transformation, Camel Tech’s focus was on systemizing the business – capturing SDA CPA’s operations in a repeatable, trackable system. By following the discovery → design → implementation → efficiency → onboarding → improvement framework, we made sure no stone was left unturned. The outcome was a ClickUp-powered workflow that addressed all of SDA CPA’s initial pain points and set them up for scalable growth.

What We’ve Implemented – At a Glance

By the end of the project, SDA CPA had an array of new tools and processes built into ClickUp. Here’s a quick overview of the key implementations and their benefits:

-

Client task spaces: Built dedicated ClickUp folders for each client with recurring monthly checklists for smooth, repeatable workflows.

-

Task automations: Automated recurring tasks, due date alerts, and status updates to reduce manual work and improve reliability.

-

Sales CRM: Designed a sales pipeline in ClickUp to capture, track, and convert leads consistently with follow-up reminders.

-

Live dashboards: Created dashboards for deadlines, workloads, and sales performance, offering leadership instant operational visibility.

-

SOPs & templates: Documented procedures and built task templates to ensure consistency and reduce onboarding time for new staff.

-

Data & file integration: Centralized client communication, files, and calendar deadlines directly within ClickUp tasks for full context access.

(Plus, Camel Tech provided ongoing support and adjustments post-implementation, ensuring the system continued to meet SDA CPA’s needs as they used it in practice.)

In summary, SDA CPA’s ClickUp implementation wasn’t just a basic setup – it was a full operational makeover. From managing prospects to delivering client work to measuring team performance, the firm now has a cohesive platform that handles it all.

Results

The partnership between SDA CPA and Camel Tech delivered impressive results, both in measurable efficiencies and in softer benefits like team morale. With 85% of their operations now systemized in ClickUp, the firm has seen a transformation in how they work day-to-day. Here are some of the most impactful outcomes after the overhaul:

-

Consistent quality and client satisfaction: Standardized workflows and SOPs ensured deliverables are consistent across the board. Clients now receive uniform, timely results regardless of team member handling the task.

-

Stronger sales and growth trajectory: The CRM increased responsiveness and lead tracking, resulting in higher client acquisition and more predictable sales pipeline performance.

-

Real-time business insight: Dashboards provide leadership with visibility into all moving parts—tasks, performance, workload—helping prevent bottlenecks and improving planning.

-

Improved team collaboration and accountability: Staff communicate through ClickUp tasks and comments, boosting collaboration while ensuring everyone knows their responsibilities.

-

Near-perfect on-time delivery: Missed deadlines dropped significantly thanks to centralized task tracking, due dates, and automated reminders.

-

Dramatic time savings: The new system saves the team 20+ hours daily, shifting focus from task chasing to client service and strategy.

Overall, SDA CPA’s transformation has been nothing short of game-changing. The firm went from a patchwork of tools and reactive task management to a highly organized, automated operation. The owners and team now have clarity, control, and peace of mind. Stanley Dean can truly step back into the CEO role knowing that 85% of the operations run like clockwork on ClickUp – allowing him to devote more energy to advising clients and strategic growth. The team, freed from tedious manual chores and chaos, can deliver better service to more clients with less stress. And the business as a whole is now set up to scale further: with a replicable system in place, SDA CPA can confidently expand its client base (and even its service offerings) without worrying about things breaking down.

Related Success Stories

Scaling a global clothing manufacturer is complex. Crease Group partnered with Camel Tech to implement custom systems and automation—transforming their operations and setting the foundation for scalable, end-to-end production.

Scaling an accounting firm is no easy task. Camel Tech helped SDA CPA implement a ClickUp-powered system that transformed their operations—bringing structure, automation, and visibility to 85% of their workflows.

Build a business that thrives without you

Let's book a call with our expert.